who claims child on taxes with 50/50 custody california

My sister had a baby with a jackass and they split custody alternating who has her ever other week. Our original agreement was that we would take turns filing every other year.

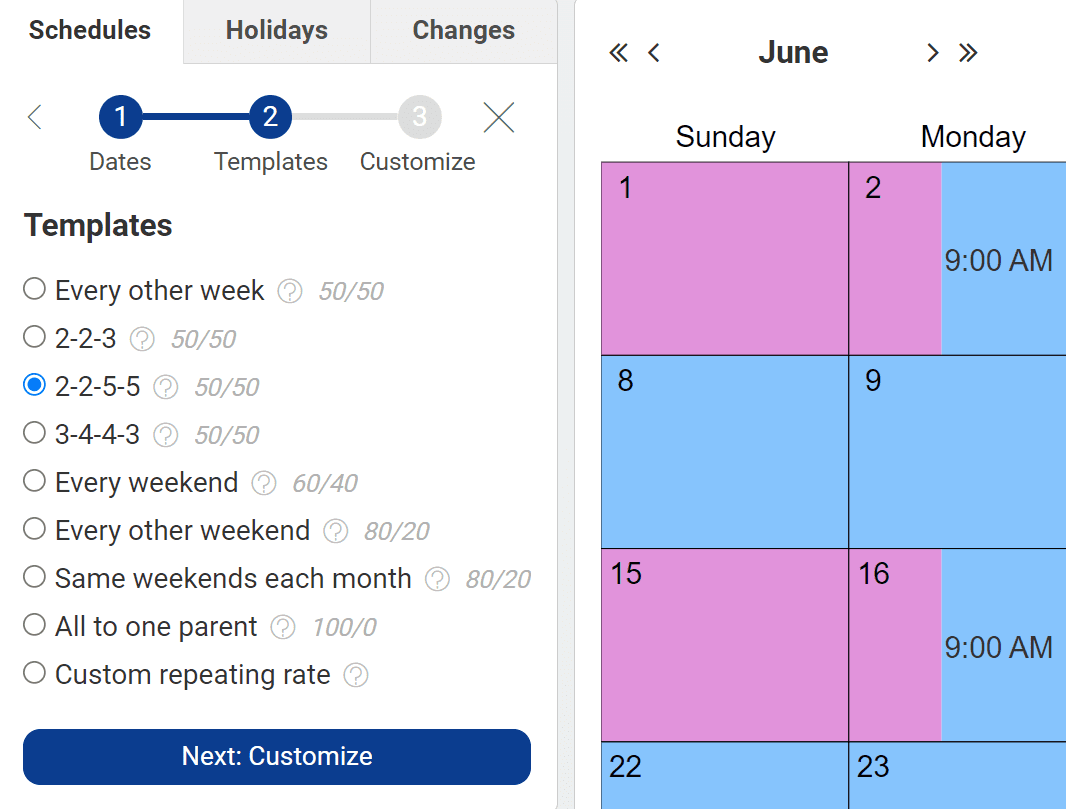

Common Shared Custody Arrangements New Daily Offers Ruhof Co Uk

The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

. Ted thinks otherwis and for the past five or six years has continued to claim both children. I was told that IRS required a parent with higher AGI to claim a child as a dependent when we have the pure 5050 physical and legal custody. The owner of that household has the right to claim the dependent exemptions and credits for that tax year.

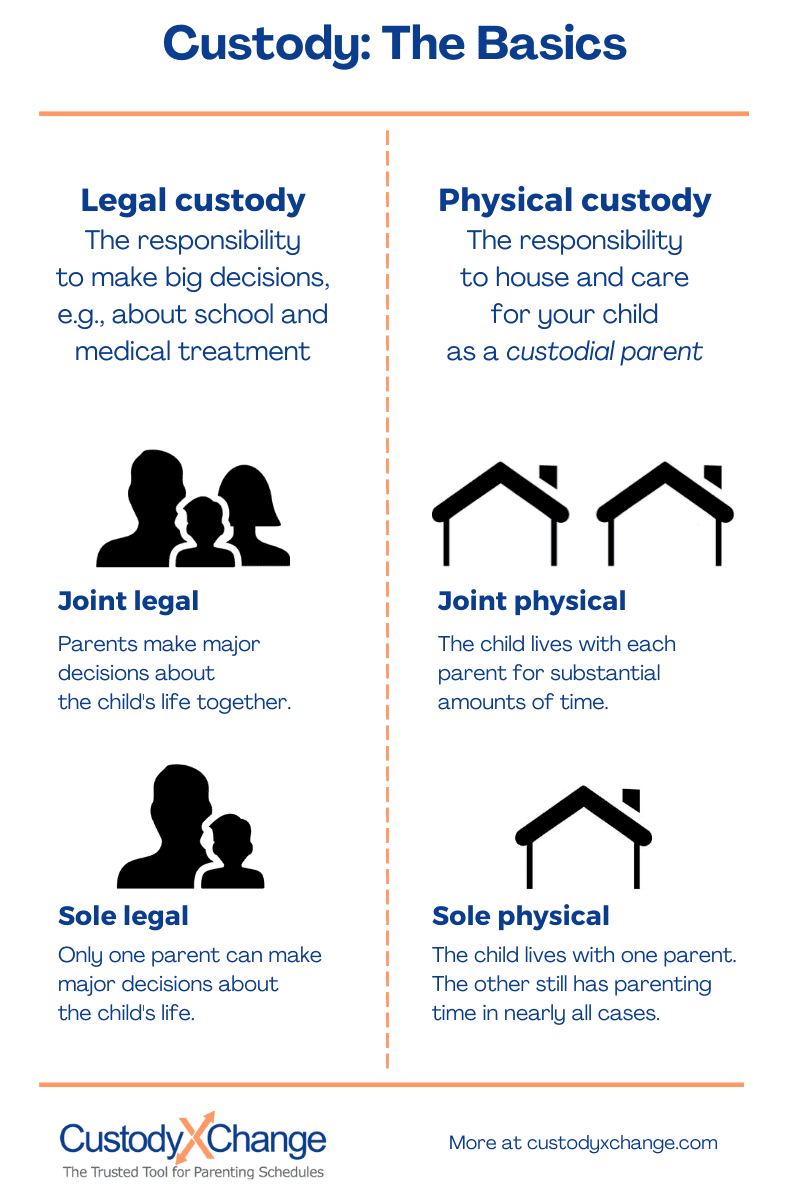

When You Have 5050 Custody Who Claims The Child On Taxes. Who Gets the Tax Exemption in 5050 Custody Cases. However most cases involve the custodial parent with joint physical custody claiming the deduction.

In California joint custody cases where parents share parenting time evenly it may not be clear who should benefit from the tax exemption. Want to stay in touch with Colorado Legal Group. The irs rule is whomever has the kids for the majority of the time claims them and in cases with 5050 the parent providing more than 50 of their costs.

Secured with SHA-256 Encryption. Receive a monthly email newsletter with insider information and special offers. My childs father and I share 5050 custody of our daughter but he claimed her on his taxes for three of the 4 years weve had her.

The IRS explains Generally the custodial parent is the parent with whom the child lived for a longer period of time during the year. Who claims child on taxes with 5050 custody michigan. Taxes and 5050 Custody.

Find the best ones near you. But the second time it was my year to file he said he had her two more days then I did the past year so. Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer How Often Do Fathers Get 50 50 Custody Quora What Is Form 8332 Release Revocation Of Release Of Claim To Exemption For Child By Custodial Parent Turbotax Tax Tips Videos.

According to the IRS this factor is the only one that matters when determining a custodial parent even if a couple has a 5050 custody agreement. This is true for parents without an exact 5050 custody split Transferring tax credit to your ex in a 5050 custody arrangement. California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes.

As a result of split 5050 child custody agreements parents with high incomes can claim their children as dependent citizens. We have 5050 custody of the children. Who Claims Child On Taxes With 50 50 Custody.

Avvo has 97 of all lawyers in the US. As for custody of a child a majority of cases involve the custodial parent who jointly administers the joint custody plan. Who Claims the Child With 5050 Parenting Time.

If the other parent with lower AGI were to file I do need to provide a form allowing him father to claim the child. He says his lawyer told him he gets to claim the child and my sister cant because he makes more money than her. The custodial parent can transfer the exemption to the non-custodial parent by providing them with a signed copy of Form 8332.

Who Claims A Child On Taxes In A 50 50 Custody Arrangement. A custodial parent will often make an argument on behalf of hisher joint physical custody of their child in most cases. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

However most cases involve the custodial parent with joint physical custody claiming the deduction. The parent with the higher adjusted gross income AGI gets to claim the child if custody is split exactly 5050 which is technically difficult when there are 365 days in a year. You who can claim a child ontaxes in a 5050 custody - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

When You Have 5050 Custody Who Claims The Child On Taxes. California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes. When it comes to claiming taxes we think that we have the right to claim one child and Ted should claim the other child that way it is equal and fair and the same as our custody arrangement.

Retirement Planning Advice for Women. The parent who has custody for the greater part of the year typically gets to claim the child as a dependent for tax purposes. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes. According to California law a child in 5050 child custody agreements may be considered taxable by both parents if they are jointly insured. Who claims child on taxes in case of joint 50 50 custody.

Who claims child on taxes with a 5050 custody split. The father insists this rule does not make any sense as he feels I benefit from the dependent care credit. However most cases involve the custodial parent with joint physical custody claiming the deduction.

The court that handles the child custody case can usually include the tax exemption as part of the order giving a clear rule for who should use the exemption. But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to. Typically the parent who has custody of the child for more time gets to claim the credit.

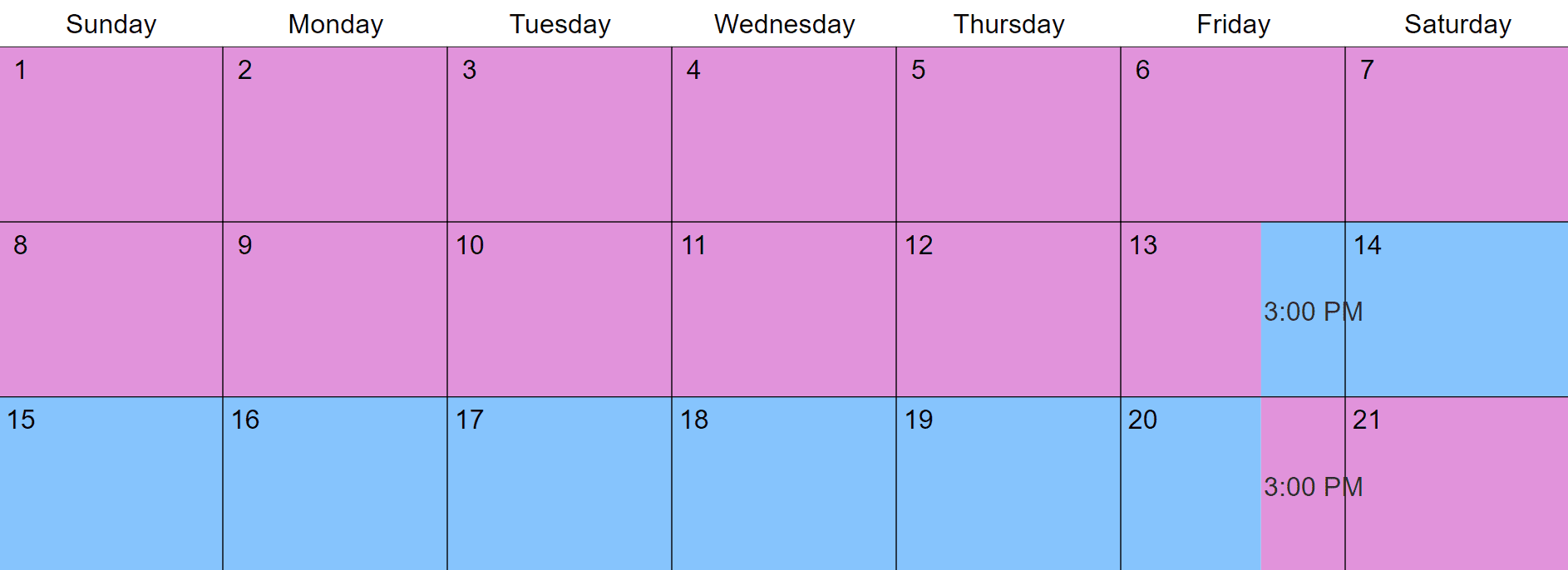

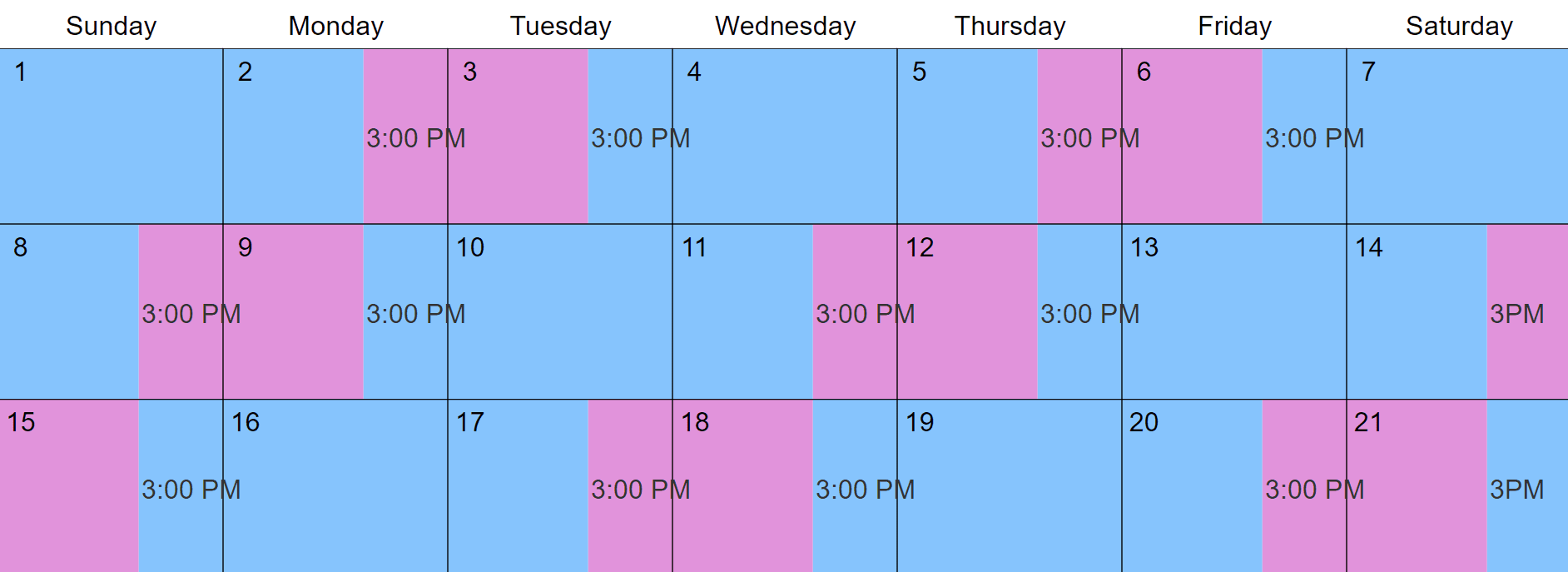

70 30 Custody Visitation Schedules Most Common Examples

Child Support Reform Promotes Involvement Closes Pay Gap

What Does A 50 50 Or Joint Custody Agreement Look Like

Do I Have To Pay Child Support If I Share 50 50 Custody

What Does A 50 50 Or Joint Custody Agreement Look Like

Sole Legal Custody Defined Advantages Disadvantages

Reasons To Deny Custody Legalzoom Com

Do I Have To Pay Child Support If I Share 50 50 Custody

Joint Custody Schedules Which 50 50 Schedule Is The Best Stepmomming Blog Joint Custody Custody Parent Schedule

70 30 Custody Visitation Schedules Most Common Examples

Considerations For Long Distance Custody Agreements

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

70 30 Custody Visitation Schedules Most Common Examples

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Common Shared Custody Arrangements New Daily Offers Ruhof Co Uk

Do I Have To Pay Child Support If I Have 50 50 Custody

How Does Child Support Work In Sharing 50 50 Custody

Joint Custody Schedules Which 50 50 Schedule Is The Best Stepmomming Blog Joint Custody Custody Parent Schedule